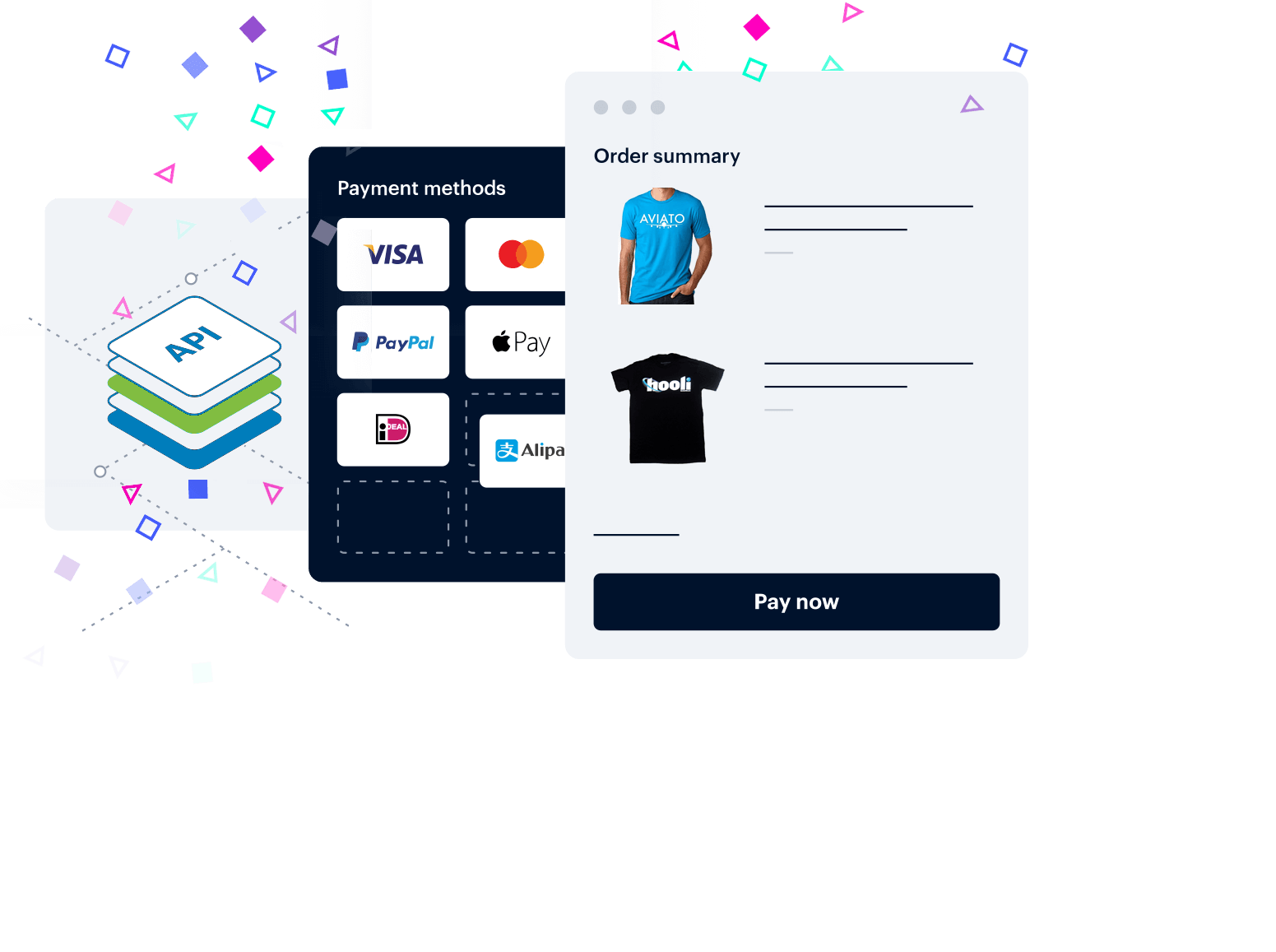

Easily add web and mobile payment acceptance to your offering

PayFac or ISO

The Hips payment platform enables your merchants to launch within minutes by provisioning both the merchant account and gateway services within a real-time manner.

Front your merchants

Acquirer

Checkout

Payment Plugins

Payments insights to power your business

WE SUPPORT YOU IN OVER 70 COUNTRIES WORLDWIDE

Major debit and credit cards

- Visa

- MasterCard

- AmericanExpress

- Maestro

- JCB

- Unionpay

- Discover

- Diners Club

Local payment methods

- SEPA Debit

- Klarna

- GiroPay

- iDeal

- Swish

- Vipps

- ACH

- Przelewy24

- Sofort

- Multibanco

- Bancontact

- Boleto

- CIMB Clicks

- eNETS

- FPX

- Interac

- Maybank2u

- mobicred

- moip Pagamentos

- MOLPay

- paydirekt

- POLi

- Trustly

- TrustPay

Stored-value digital wallets

- PayPal

- AliPay

- WeChatPay

- Carrier Billing

- moneta.ru

- Paylib

- paysafecard

> curl --request POST --url https://api.hips.com/v2/payments \--header 'Accept: application/json' \--header 'Authorization: private_BQokikJOvBiI2HlWgH4olfQ2' \--header 'Content-Type: application/json' \--data '{ "source": "card","card": { "number": "4111111111111111", "exp_month": "01", "exp_year": "21", "cvc": "123" },"purchase_currency": "USD","amount": 995,"customer": { "email": "john@doe.com" }}'> curl --request POST --url https://api.hips.com/v2/tokens \ --header 'accept: application/json' \ --header 'content-type: application/json' \ --data '{ "source":"card", "card":{ "number":"4111111111111111", "exp_month":"12", "exp_year":"25", "cvc":"123" }}'> curl --request POST --url https://api.hips.com/v2/payments \--header 'Accept: application/json' \--header 'Authorization: private_BQokikJOvBiI2HlWgH4olfQ2' \--header 'Content-Type: application/json' \--data '{"source": "card_token","card_token": "73jWmRr6iGmiDN14UH6cut6g","purchase_currency": "USD","amount": 995,"customer": { "email": "john@doe.com" }}'> curl --request POST --url https://api.hips.com/v2/orders \ --header 'Accept: application/json' \ --header 'Authorization: private_BQokikJOvBiI2HlWgH4olfQ2' \ --header 'Content-Type: application/json' \ --data '{ "order_id": "123", "purchase_currency": "USD", "cart": { "items": [{ "type": "physical", "name": "Hips cup", "quantity": 1, "unit_price": 1000 }]}}'API BUILT WITH DEVELOPERS ❤️ IN MIND

Features and benefits

Virtual Terminal

Swipe cards or key in payment details over the phone or through mail order from a browser.

Reporting Capabilities

Get detailed insight into transactions and use the Transaction Search tool to find exactly what you’re looking for.

Recurring Billing

Bill customers on a regular basis by establishing a recurring billing schedule.

OneClick Checkout

Quickly and easily integrate a website to our OneClick Checkout with one of our plugins.

Third-Party integrations

Access processor integrations and a growing list of shopping cart integrations

Transaction Routing

Automatically determine which MIDs to route transactions to, based on active routing directives using a single gateway account.

Batch / Offline Processing

Upload files to the platform and process large volumes of transactions all at once.

Product Manager

Enter and manage product SKUs and keep inventory organized with our unified product database.

Flexible Integration Methods

Full customization and control over accepting payments within your own mobile applications and software with our diverse APIs and SDKs.

QuickPay

B2B/B2C solution to quickly accept payments in already issued invoices where the amount is unknown.

Point of Sale Financing

Offer the customer the option to part pay, or pay later direct in the checkout / Point of Sale

Anti Fraud

Anti Fraud system based on machine learning. Add your own business rules if you want.

Dispute management

Manage disputes and chargebacks, and let the merchant work and respond to them directly in their admin portal.

Mutilingual

The whole platform - all parts - are translated into 18+ languages.

Multicurrency

Multiple authorization and settlement currencies

DCC / Currency Convertion

Real time currency conversion with markup possibilities. Customer can opt in/out direct in checkout / Point of Sale

Reconciliation

Reconciliation service creates ISO 20022 / CAMT bank files for seamless payout to your merchants.

Automated Onboarding

Automated onboarding of merchants where they provide passport, business documents and a selfie via our onboarding system.

Terminal management (TMS)

Remotely manage your payment devices including any necessary firmware updates required for security or continued EMV compliance.

Cloud HSM

PCI-HSM certified Cloud based HSM solution. Skip hardware scaling and maintenance problem.

BRAM Monitoring

MasterCard certified merchant BRAM monitoring solution.

Point to Point Encryption (P2PE)

Ensure cardholder data is not exposed at any time during a payment transaction with P2PE, the most secure and effective solution.

Remote Key Injection

Instead of the traditional manual process, use the more cost effective and faster alternative to automatically and securely complete payment terminal key injection at the point of sale.

Tokenization

Reuse tokenization cardholder data from previous transactions without having to store or secure it. The token can be used for subsequent transactions without the cardholder data being re-entered.

Strong Customer Authentication (SCA)

PSD2 and SCA-Ready Fraud Protection for Ecommerce and InStore

3D Secure 1.0.2

Fallback 3D secure protocol for card issuers that does not support the new EMV® 3DS 2.0

3D Secure 2.0 (EMV® 3DS)

3DS2 is designed to improve upon 3D Secure 1 (3DS1) by addressing the old protocol's pain points, and delivering a much smoother and integrated user experience along with biometric authentication.

EMV QR Payment

Merchant presented ISO 18004-compliant EMV QR Payments both Online and In-Store.